Do you have savings? Whether you’re saving for a new home, a holiday, or simply building a cushion for unexpected expenses, every pound you save brings you closer to your goals and increases your financial resilience.

Saving isn’t just about putting money aside. It’s about peace of mind, knowing that you’re ready for whatever life throws your way. From round-up savings to Cash ISAs, there’s a method for everyone.

Let’s dive into practical tips that make saving achievable, no matter where you’re starting.

Why Many People Struggle to Save

Imagine waking up to an unexpected expense—a broken boiler, an urgent car repair, or an emergency that demands immediate attention—and having no savings to cover it. Surprisingly, one in six UK adults face this reality, living without a financial cushion.

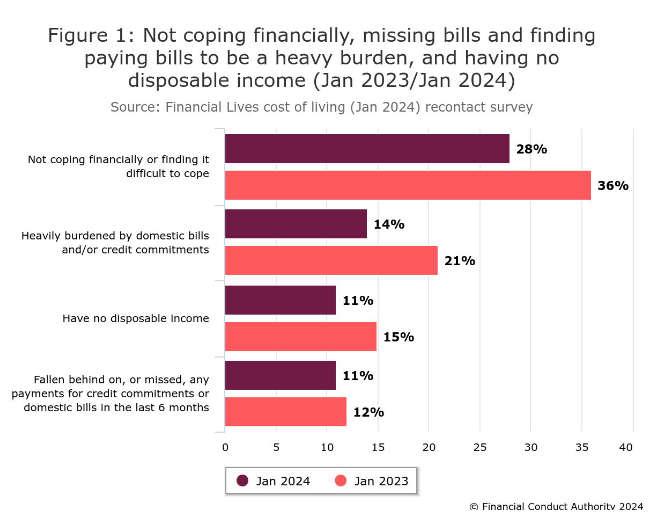

Saving money is a daily challenge for millions. Recent FCA data shows that 28% struggle to cope financially, with 21% heavily burdened by bills and 15% having no disposable income. This highlights the struggle many face in building even modest savings.

Image: FCA

The struggle to save stems from everyday realities:

- Low income: Many find it hard to save when earnings barely cover basic expenses.

- High living costs: Increasing prices for essentials like housing and groceries leave little for saving.

- Debt: Repaying loans and credit cards often take priority.

- Lack of financial education: Many don’t know where to start or feel overwhelmed by savings options.

It’s easy to feel stuck when faced with these challenges. However, even small, manageable steps can break the cycle and help build a safety net for the future

How to Start Saving: Practical Tips for Beginners

You don’t need a financial background or a hefty income to start saving. These easy-to-follow tips are meant to help beginners get started, even if it’s just a few pounds at a time.

Challenge Yourself with a 'No-Spend' Week

Set yourself a fun and slightly challenging task: a no-spend week. This involves avoiding all non-essential purchases for seven days. No takeaway coffees, no online shopping splurges—just the basics. It’s a good way to find areas to cut back and see how much you can save.

Establish a Digital Envelope System

The envelope budgeting method has been modernised into a digital format. Allocate funds into virtual “envelopes” for various categories and once an envelope is empty, it’s empty. This strategy helps control spending and stay on track with your savings goals

Save Your Windfalls

When you receive unexpected money like a work bonus, tax refund, or cash gift, consider putting it directly into your savings account. By doing so, you can grow your savings without affecting your regular income.

Create a 'Spare Change' Jar—With a Twist

Remember the classic spare change jar? Take it up a notch by setting a rule: every time you get change, drop all the coins into your jar. Then, periodically deposit the accumulated amount into your savings account. The twist? You never use the coins for spending—only for saving.

Use the 30-Day Rule

If you’re thinking about making an impulsive purchase, wait 30 days. If you still want the item by the end of the month, it might be worth buying. But most of the time, you’ll find that the urge has passed, and you’ve saved that money instead.

Maximising Small Change With Round-Up Savings

Round-up savings is a simple, hands-off way to build your savings effortlessly. This method rounds up your everyday purchases to the nearest pound and saves the spare change, turning small, unnoticed amounts into a growing savings pot.

How It Works

Let’s say you buy a cup of coffee for £2.50. Round-up savings will round it up to £3.00, saving you 50p. Clockwise Credit Union and other providers offer this feature, helping you save as you spend. Over time, these small amounts add up significantly without you even noticing.

Why It's Effective

Round-up savings works because it’s effortless—saving tiny amounts consistently without changing your spending habits. It’s ideal for those who struggle to set aside large sums and often comes with interest, allowing your money to grow passively. This approach makes saving feel easy, turning spare change into a valuable financial cushion.

Growing Your Savings Tax-Free with Cash ISAs

Cash ISAs (Individual Savings Accounts) offer a great opportunity to increase your savings without being taxed on the interest you earn. Unlike regular savings accounts, the money you make from a Cash ISA is completely tax-free, making it an appealing option for anyone looking to maximise their returns.

Why Choose a Cash ISA

Cash ISAs offer several advantages:

- Tax-free interest: Keep all the interest you earn with no tax deductions.

- Safe and secure: Your money is protected, giving you peace of mind.

- Flexible withdrawal options: Access your savings when you need them, or let them grow undisturbed.

In comparison to regular savings accounts, Cash ISAs offer the added benefit of tax-free interest, which can significantly enhance your overall savings over time.

How to Open One

Opening a Cash ISA is straightforward, especially with providers like Clockwise Credit Union. You can set up an account through the Clockwise app, making it easy to start saving right from your smartphone. Deposits are simple, and with a competitive AER interest rate, your savings can flourish.

How to Choose the Right Savings Account

To optimise your financial growth, selecting the right savings account is essential. Consider these key factors:

- Look for accounts offering competitive rates.

- Decide if you need instant access to funds or prefer locking them away.

- Check for any maintenance or transaction fees that could reduce your savings.

Always compare different options and consider using a combination of accounts—like a round-up savings account for short-term goals and a Cash ISA for long-term growth.

Begin Your Savings Journey with Confidence

Even small amounts in your savings can build a more secure future. It might seem difficult to start, but you can begin with simple methods like taking on weekly challenges or considering options like round-up savings and Cash ISAs. So why wait?

Start saving today with Clockwise Credit Union’s round-up savings and Cash ISAs to ensure your financial future and experience the comfort of having a dependable safety cushion.