Since the cost-of-living crisis, more and more individuals have been struggling to remain afloat. The price of just about everything, from food to electricity to heating, has skyrocketed in the last few years.

Sadly, the amount people are paid has not risen alongside these prices. Naturally, more and more people are finding it difficult to afford even the basic necessities.

This is putting an additional stress on many people in the UK. Thankfully, steps are being taken to address the UK’s struggles with mental health, and Mental Health Awareness Week is one of these. The week aims to raise awareness and provide solutions.

So, what can you do to mitigate these effects while you’re struggling? We’ll provide some practical advice about coping.

The Link Between Financial Instability and Mental Health

Financial instability is a significant stressor that can profoundly impact mental health. When individuals face uncertainty about their ability to meet basic needs, it triggers emotional and physical stress.

Economic hardships such as job loss, unexpected bills, or prolonged debt can cause chronic stress, which is linked to increased rates of depression and anxiety.

The stress associated with financial instability isn’t just about the immediate lack of funds but also the long-term uncertainty it creates. This ongoing strain can exhaust an individual’s mental and emotional resources, making it harder to cope with daily challenges.

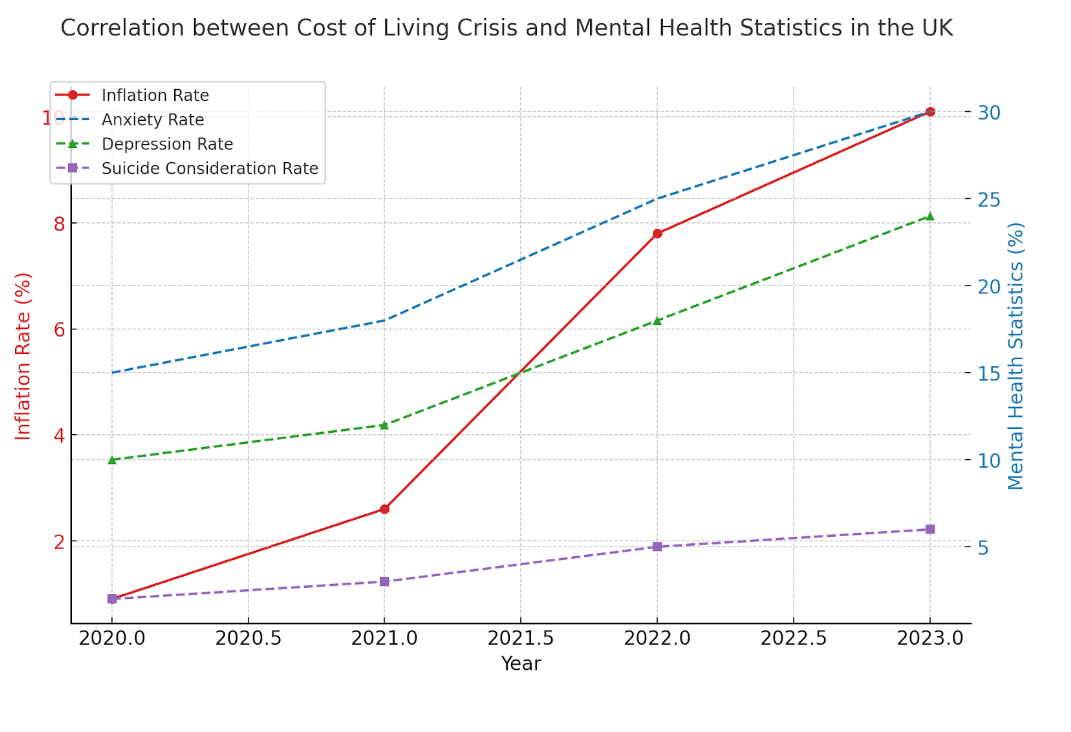

A graph illustrating the correlation between the cost of living crisis (represented by the inflation rate) and mental health statistics in the UK over recent years. The graph shows an increase in the rates of anxiety, depression, and suicidal consideration alongside rising inflation rates, highlighting the significant impact of economic pressures on mental health.

Chronic stress disrupts sleep, exacerbates health problems, and can lead to decreased cognitive function, further impedes one’s ability to manage finances effectively.

Moreover, financial instability often carries a stigma, leading to shame and social isolation, which compounds mental health issues. People may hesitate to seek help or share their struggles due to fear of judgment, thus worsening their situation.

Addressing this link means not only recognising the profound effects of financial stress on mental health but also integrating financial guidance and psychological support to help individuals regain stability and improve their overall well-being.

Emotional Responses to Financial Instability

Financial instability can trigger a range of emotional responses that can deeply affect an individual’s mental health and overall quality of life. Here are some of the key emotional reactions people may experience:

- Anxiety and Panic: One of the most common responses to financial instability is anxiety. This can manifest as constant worry about how to pay bills, manage debt, or provide for one’s family. The uncertainty of not knowing where the next paycheck will come from or how to cover unexpected expenses can lead to severe anxiety, disrupting daily life and decision-making abilities.

- Depression: Chronic financial stress can lead to feelings of helplessness and hopelessness, key symptoms of depression. When individuals feel unable to change their financial situation, this can result in a persistent sad mood, loss of interest in activities, and withdrawal from social interactions, further exacerbating feelings of isolation.

- Shame and Isolation: Financial difficulties are often stigmatised, making many feel ashamed or embarrassed about their situation. This shame can prevent individuals from seeking help or sharing their struggles, which isolates them and limits their access to resources that could improve their situation.

- Stress: Chronic stress from financial instability can affect physical health, leading to problems like high blood pressure and heart disease.

- Denial: Some individuals may respond to financial stress by going into denial, avoiding the reality of their financial situation. This can include avoiding bills, not opening bank statements, or continuing spending behaviours exacerbating financial problems. While this may temporarily alleviate stress, it often leads to greater difficulties later on.

Addressing these emotional responses involves recognising the impact of financial stress and taking steps to manage both the financial issues and their emotional consequences. Strategies like seeking financial counselling, joining support groups, and practising mindfulness can help alleviate some of the emotional burdens of financial instability.

Coping Mechanisms

So, we now understand the possible impacts of financial stress. But what can you do about it?

Fortunately, there are many ways to begin coping with the emotional stress of financial instability.

Here are some effective coping mechanisms that can help individuals manage their financial stress and improve their mental health:

One of the first steps in managing financial stress is to gain control over your finances. Yes, this is a lot easier said than done, especially when, in so many cases, the basic necessities simply cost too much. But there are still small steps you can take. Detailed budgeting and financial planning can help you understand where your money goes, and identifying areas where you can cut costs can help relieve immediate financial pressure.

Sometimes, the guidance of a professional financial advisor can make a significant difference. They can help devise strategies to manage debt, save effectively, and plan for future financial stability. Additionally, they might provide resources and options you weren’t aware of. Of course, this usually comes at an additional cost, and so may cause more problems than it solves.

Practices such as meditation, deep breathing exercises, and yoga can help manage the physiological and psychological symptoms of stress. These techniques can lower overall stress levels, helping you maintain a clearer mind to tackle financial issues.

Treat it like you would another mental health issue and follow the steps for managing those conditions.

Of these, exercise or taking a walk outside is free and easy. Regular exercise is a powerful stress reliever. Whether it’s walking, running, cycling, or any other form of physical activity, exercise releases endorphins, which can improve your mood and reduce feelings of anxiety and depression.

Don’t keep it bottled up. Sharing your struggles with trusted friends, family members, or a support group can provide emotional relief and practical advice. Sometimes, just knowing that others understand and support you can make a huge difference in your mental state.

Consulting with a therapist or counsellor can help address the emotional responses to financial stress. Mental health professionals can provide coping strategies specific to your situation and help you deal with feelings of anxiety, depression, or low self-esteem.

By integrating these coping mechanisms, individuals can better manage the stress of financial instability and protect their mental health during challenging times.

Resources and Help

For those facing financial instability, there are various resources and forms of help available that can provide both immediate relief and long-term support.

Financial Assistance Programs

- Government Benefits: Check eligibility for government assistance programs such as unemployment benefits, food stamps (SNAP), or temporary assistance for needy families (TANF).

- Local Community Organizations: Many communities have local organisations that offer financial assistance for utilities, rent, and food. Organisations like the Salvation Army, United Way, or local food banks can provide immediate help.

Financial Counselling

- Non-Profit Credit Counselling: Organisations like the National Foundation for Credit Counseling (NFCC) offer free or low-cost services such as debt management plans, budgeting assistance, and financial education.

Mental Health Support

- Counselling Services: For those struggling with stress, anxiety, or depression due to financial issues, mental health professionals can offer support. Sliding scale therapy services or community mental health centres offer services based on your ability to pay.

Legal Assistance

- Legal Aid: If you’re dealing with eviction, foreclosure, or debt collection, legal aid organisations can provide free or low-cost legal advice and representation.

While not all of these steps will work for everyone, it’s good to know what support exists. Many one or two, or even all of them, will suit you. Remember that while it can seem incredibly overwhelming and stressful, there are lots of forms of help available.