Notts and Lincs Credit Union has joined forces with Clockwise Credit Union to offer members even better services and perks. If you are a Notts & Lincs member, don’t worry, all your savings and loan accounts will be moved over to Clockwise Credit Union without you needing to do anything and you’ll be able to enjoy our upgraded services right away.

This merger is an important step in improving the services and support Notts & Lincs provide to their members.

The merger took place on 1st February 2025. From that point on Notts & Lincs Credit Union became Clockwise Credit Union.

Loans

Savings

Current Account

If you are a member of Notts & Lincs CU, you will have received a letter with your updated account details. To use the Clockwise online service, you’ll need to register. To make it easy, we’re sending everyone a registration code and instructions on how to sign up. Keep an eye out for your unique code in the post.

This merge means you are now part of the largest community Credit Union in the East Midlands – with a combined membership of over 33,000.

What to Expect from the Merger:

Enhanced Benefits and Services

- Faster and more reliable transactions, including 24-hour payments and quicker loan applications

- Easy-to-use mobile and online banking

- New savings accounts with higher interest rates, allowing you to save up to £85,000

- Current Account to set up Direct Debits & Standing Orders

- Better security to keep your account safe

- We’re making membership processes quicker and easier so it willl be simpler for you to manage your membership.

Financial Stability and Growth

Stronger Financial Foundation: The merger will make us more financially stable, so we can invest more in services for our members and in community projects.

Opportunities for Growth: As we grow together, we expect new chances for members to get involved and benefit.

We are committed to ensuring a smooth transition with minimal disruption to your current services.

We believe this merger will bring great changes and new opportunities for all members. Thank you for your ongoing support and involvement with Notts & Lincs Credit Union. Together, we’ll create a stronger and more dynamic organisation.

If you have any questions or worries, please feel free to contact us.

FAQ

Standing Orders & Other Payments

When changing your standing orders or other payments to your new Clockwise account, it’s important to remember the account details are your personal account details.

That means when entering the Account Type choose ‘Personal’ and not ‘Business’, and the account name is your name, not the name of the Credit Union.

All Clockwise savings and deposits up to £85,000 are covered by the Financial Services Compensation Scheme. Click here to find out more information.

The interest rate and terms of any outstanding Notts & Lincs loans will remain unchanged for the duration of the loan. If you take out a new loan, be sure to familiarise yourself with the up-to-date terms & conditions.

Online banking will move to the Clockwise website and mobile app. The existing Notts & Lincs online banking will shut down at the end of Jan 2025 and members will be able to start using the Clockwise service from 3rd Feb.

You will need to register to access the Clockwise service. To make this as easy as possible we are sending a registration code and instructions on how to register to all members. Look out for your unique registration code in the post.

Yes, the Notts & Lincs office will remain open with the existing staff. Opening hours for our branches in Leicester and Nottingham are Monday, Wednesday and Friday from 10am until 2pm.

Following the merger, all members will receive a new sort code and account number. Using your new details, you can pay money into your account by faster payment 24 hours a day with the money showing in your account straight away.

Payments made using the old Notts & Lincs bank account will continue to be received as normal for the foreseeable future.

We do not lend money to people who would not be able to afford to pay the loan as it would not be in their best interest and may make matters worse.

If you have been turned down for a loan, you might want to consider saving a little or perhaps opening a budget account to help get yourself back on track. It will help us build a relationship with you, so next time perhaps we can say yes.

No, all payments which currently go to your Notts & Lincs account will be received into your Clockwise account.

The 0330 004 0842 phone number will continue to work for a period of time. The Nottingham branch staff will continue to take your calls on this number

We have a general phone number for all members across the common bond to use – 0330 175 5792

The Notts & Lincs email address info@nottsandlincscu.co.uk will continue to work

With Clockwise you will have the opportunity to apply for a top-up loan up to every four months. All loans are considered on loan criteria, as agreed by the Directors, and affordability checks.

You will need to contact your bank to give them the new account number and sort code, there is no need for a reference number on the amended standing order. Other than benefit payments, if you get payments from anyone else you will need to contact them and ask them to make the change.

Payments made to the old Notts & Lincs account details will continue for a period of time.

Currently, Clockwise has a Maximum saving limit of £85k per member

No, we pay annual interest currently 0.5%, and more on our ISA and other accounts.

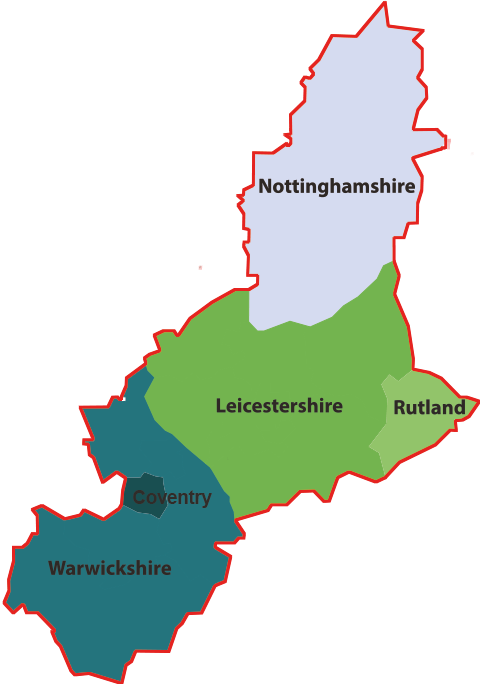

Seeking approval for the merger has not been without its challenges. There is a legal limit to the number of potential members any credit union can have, topped at three million.

Clockwise and Notts & Lincs had to adjust their common bonds to fit the regulatory requirements.

For Clockwise, that meant removing Northamptonshire from our common bond – thankfully also covered by Commsave Credit Union so people are still able to access credit union services.

For Notts & Lincs, they decided to remove Lincolnshire from their common bond, though that county will shortly be taken up by Hull and East Yorkshire Credit Union, so again new members in that area will still be able to access credit union services.

It is important to stress that existing members in both Northamptonshire and Lincolnshire will retain their membership and still be

able to access their existing accounts and services.

Your pledged savings will continue to be to be held until the loan ends or you take out a new loan. New savings will continue to be added as per your original loan agreement.

If you set up a savings goal on the Notts & Lincs app, you will need to set this goal up again in the Clockwise app. Learn more here.